B2B Lead Generation Agency Pricing: What You Should Pay

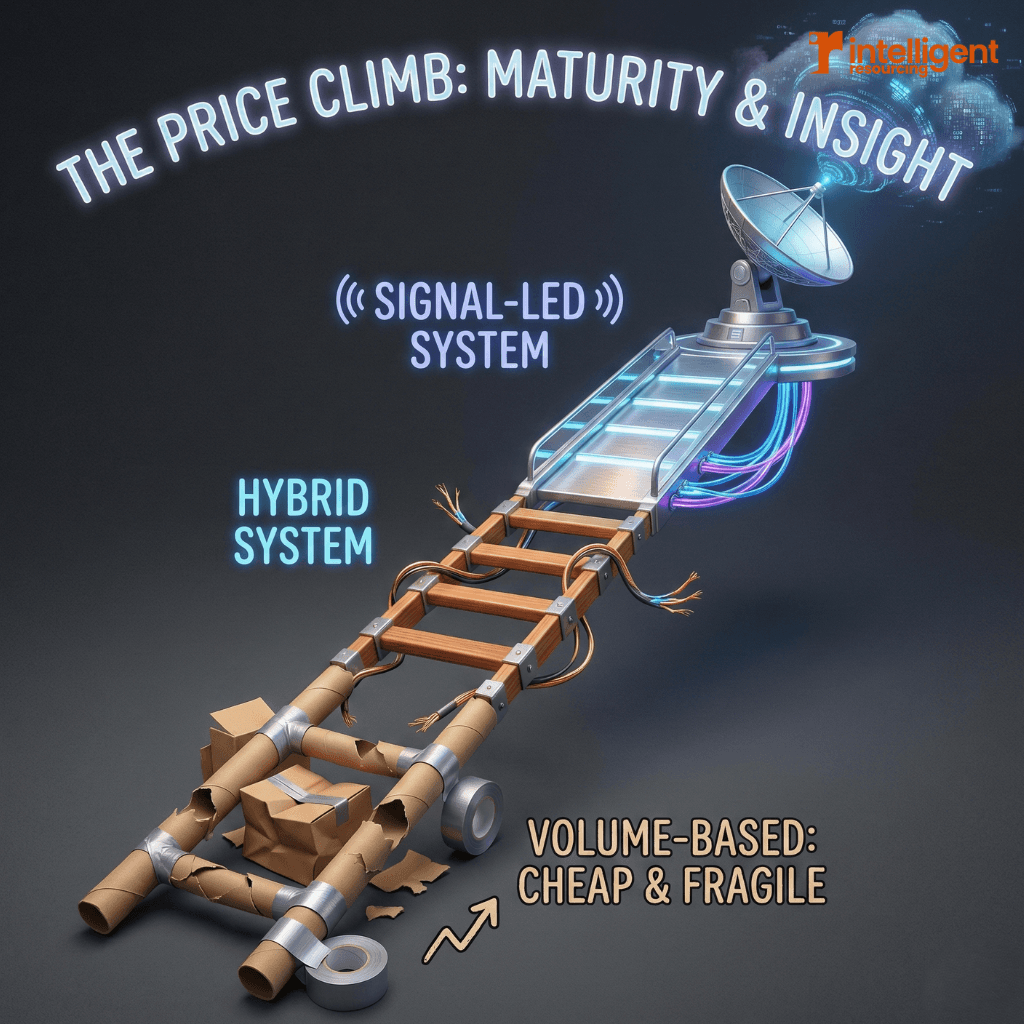

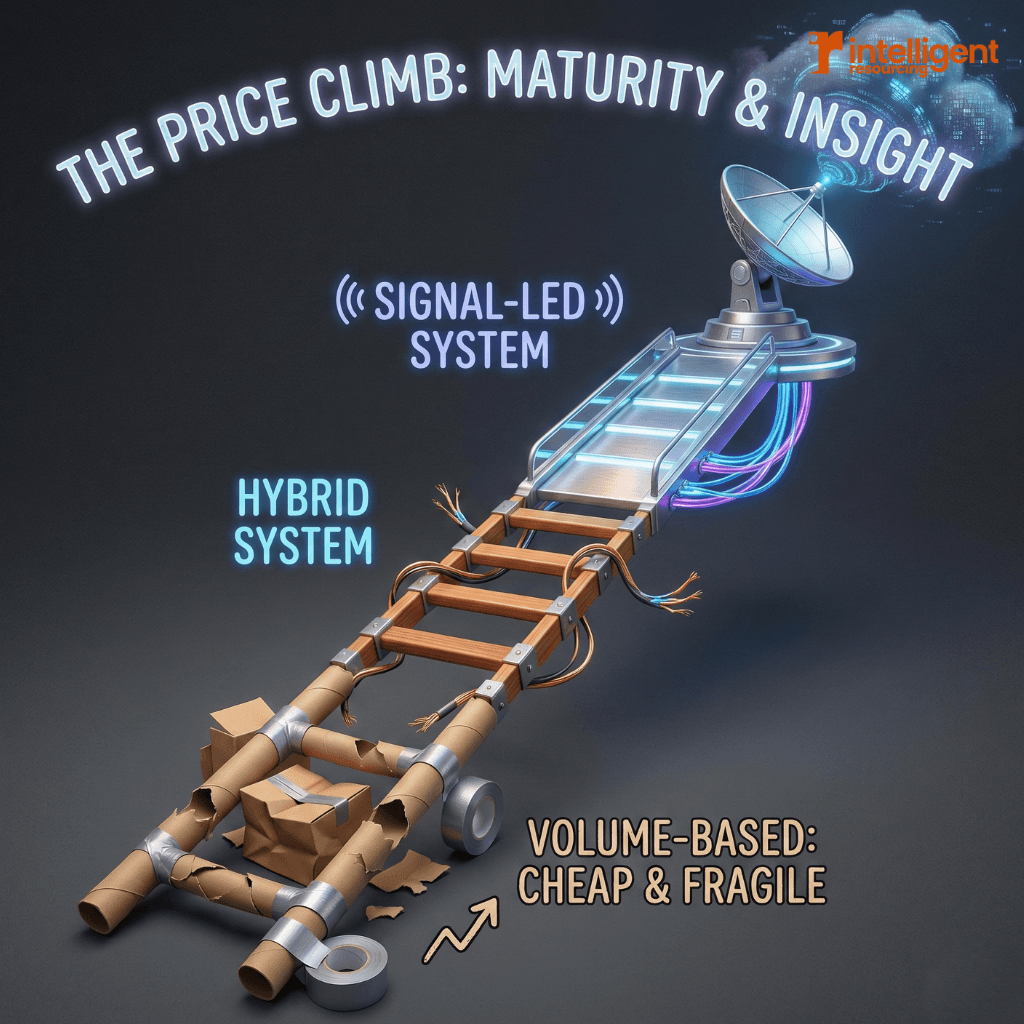

In 2026, B2B lead generation agency pricing typically ranges from $2,500 to $19,000+ per month. Lower tiers buy outreach volume and manual effort. Higher tiers pay for signal-led growth: real-time intent detection, AI orchestration, and conversion-focused execution. The right price is defined by signal quality and timing, not the number of leads delivered.

$2.5k–$5k: volume and activity, limited signal

$6k–$10k: hybrid systems with partial intent data

$11k–$19k+: signal-led growth that prioritises buying windows and pipeline impact

Rule of thumb: pay for decision accuracy, not contact quantity

Pricing Tiers by Service Type

Entry-Level / Volume-Based ($2.5k–$5k per month)

What you get

Manual prospecting and list building

Cold email or LinkedIn outreach

Basic reporting (opens, replies)

What's missing

Real-time intent or behavioural signal

ICP validation beyond surface filters

Conversion accountability

Best for

Early-stage firms testing messaging

Short-term pipeline fill (with risk)

Reality check: cheap leads often create expensive sales cycles. Quality B2B lead generation agency retainers typically range from $3,000–$25,000+ per month, with most outcome-oriented firms clustering around $5,000–$12,000 monthly.

Mid-Market Hybrid ($6k–$10k per month)

What you get

Mix of automation and human execution

Light intent or enrichment data

CRM integration and basic attribution

What's missing

Full signal coverage across channels

Buying-window prioritisation

Advanced orchestration logic

Best for

Teams with defined ICPs and sales capacity

Companies moving beyond spray-and-pray

Signal-Led Growth Systems ($11k–$19k+ per month)

What you get

Multi-source intent and behavioural signals

AI-led orchestration with human oversight

Tight CRM survivability and attribution

Continuous optimisation against pipeline outcomes

What's missing

Very little, except patience for system learning

Best for

Scale-ups and established B2B firms

Revenue teams focused on efficiency, not vanity metrics

What's Worth Paying For in 2026

When evaluating price, ignore deliverables and interrogate capability:

Signal sources

Real intent (search behaviour, content consumption, in-market actions), not scraped lists. Cost per lead varies enormously across channels and industries in B2B sectors, benchmarks often exceed $200 per lead, making raw volume less meaningful without quality and qualification.

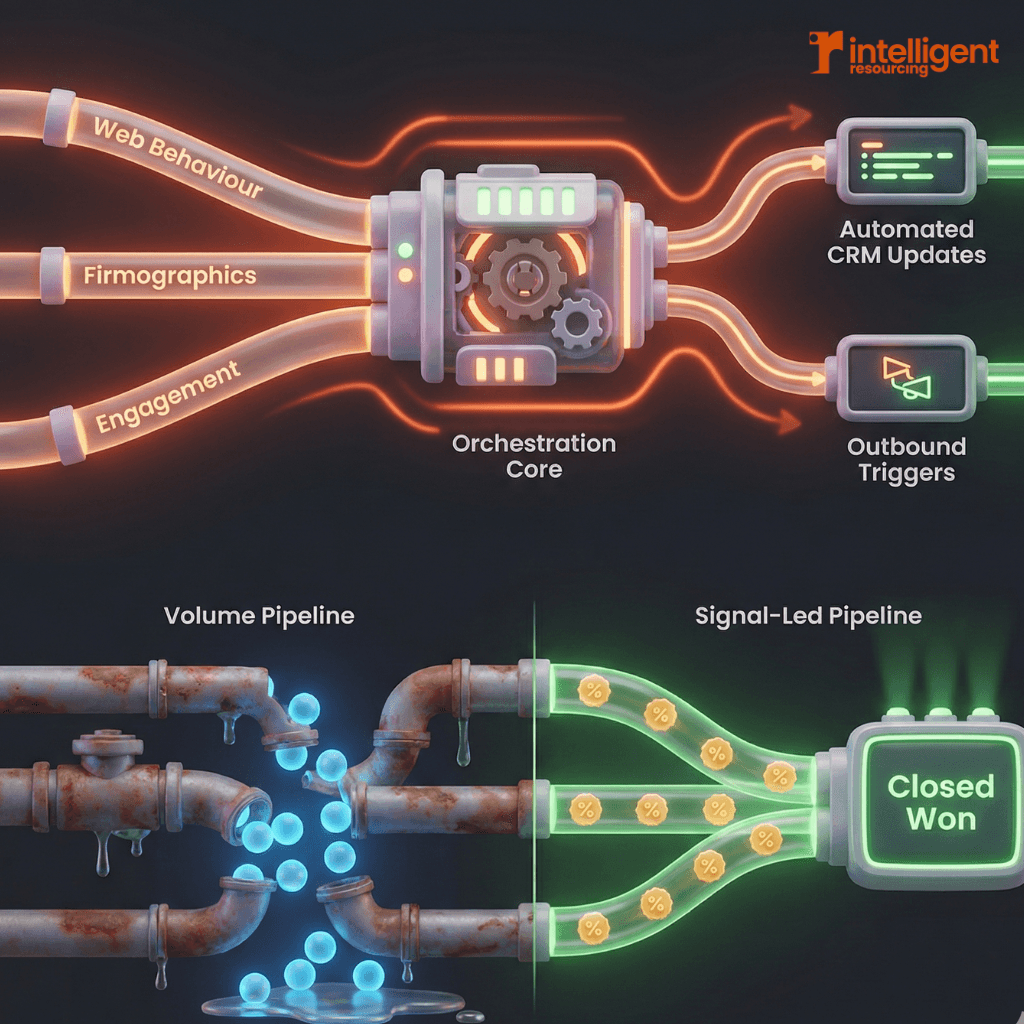

Orchestration, not automation

Automation sends messages. Orchestration decides when, who, and why.

CRM survivability

If data decays or attribution breaks, ROI becomes guesswork.

Risk management

What happens when a signal is wrong, markets shift, or volume drops?

If a proposal can't clearly answer these, the price is irrelevant.

Red Flags in Lead Generation Pricing Models

Watch for these warning signs:

Pay-per-lead pricing

Incentivises quantity over quality. Leads ≠ opportunities.

"Unlimited outreach" promises

Usually means low personalisation and high brand risk.

Black-box AI claims

If the agency can't explain where signal comes from or how decisions are made, assume guesswork. Outsourced lead generation partners cite benefits like faster pipeline creation and specialised expertise, but pricing models without transparency can result in hidden costs and poor ROI.

Guaranteed numbers

Buying intent fluctuates. Guarantees often mask recycled data.

Why Signal-Led Growth Costs More, and Pays Back Faster

Architecture (where it lives): signal spans web behaviour, firmographics, and engagement history.

Integration (how it flows): APIs and logic connect signal to CRM and outreach in near real time.

Risk (what breaks): without signal, teams chase accounts after buying decisions are made.

Higher retainers fund systems that remove pipeline waste, often delivering payback in fewer closed deals than volume-led models require. B2B digital marketing benchmarks underline that higher quality leads whether via SEO, email, or targeted outreach produce better conversion and ROI than cheap volume alone.

How to Choose the Right Pricing Model (Decision Matrix)

Model | Typical Cost | Signal Quality | Risk Profile |

Volume-based | $2.5k–$5k | Low | High |

Hybrid | $6k–$10k | Medium | Medium |

Signal-led | $11k–$19k+ | High | Low |

Verdict

If you need fast activity and accept inefficiency, choose volume.

If you want balance and learning, choose hybrid.

If you want predictable pipeline velocity, choose signal-led growth.

FAQs

Is pay-per-lead ever worth it?

Rarely. It optimises for delivery, not outcomes, and often inflates downstream costs.

Why do some agencies look cheap but cost more in the long term?

Because low signal creates longer sales cycles, higher churn, and wasted SDR time.

How long before signal-led programmes pay back?

Typically one to two closed deals in mid-market B2B can cover several months of fees.

Final Thought

In 2026, the smartest B2B teams don't ask "How much does lead gen cost?"

They ask "How much pipeline waste does this remove?"

That question almost always reframes the price.

References

Outbound Sales Pro (2025) - Complete Guide to Models, Pricing & Choosing the Right Partner.

Sopro (2025) - B2B cost per lead benchmarks by channel and industry.

Martal Group (2025) - Major Takeaways: B2B Digital Marketing Benchmarks.

Unbound B2B - Outsourcing Lead Generation: How to Calculate Lead Generation Outsourcing Costs?