B2B Lead Generation Services in Australia — Process, Pricing & Outcomes

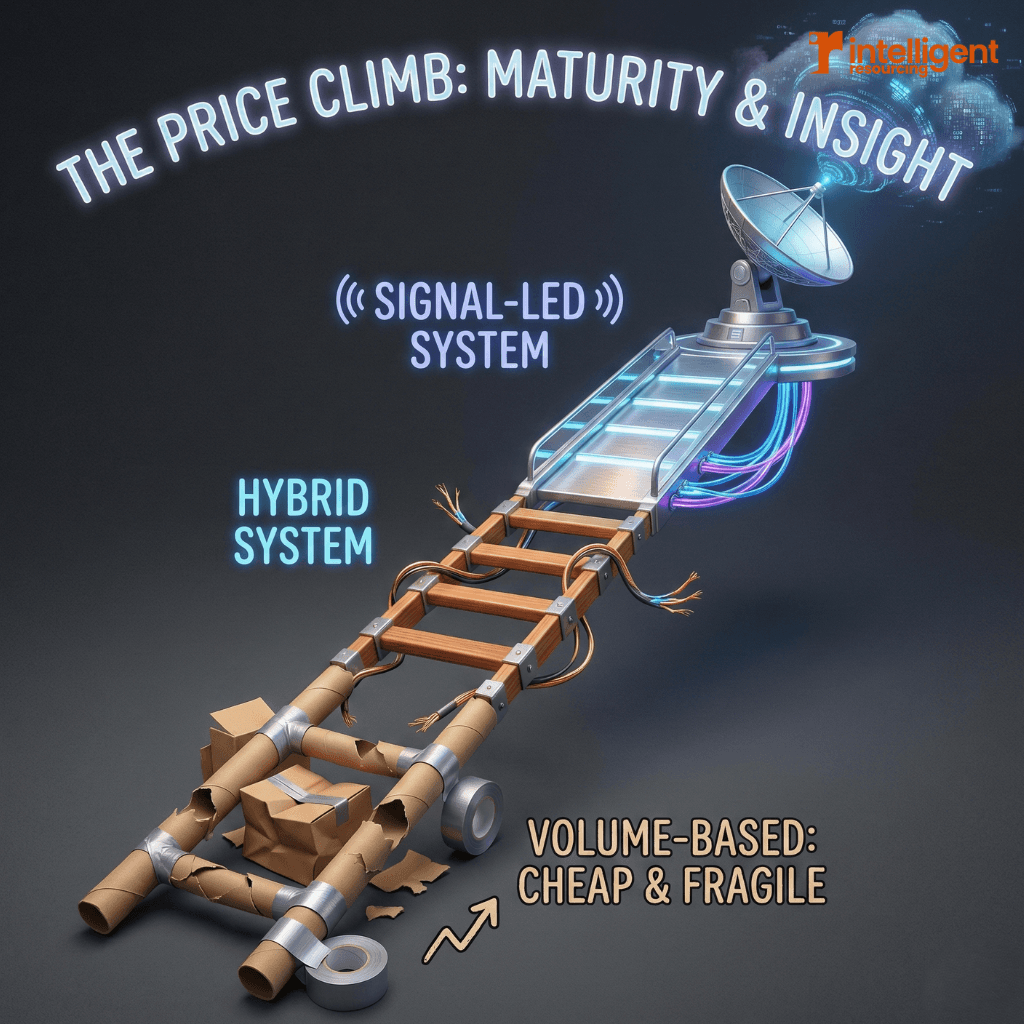

B2B lead generation services in Australia range from low-cost, volume-driven agencies to signal-led growth partners that engineer pipeline outcomes. Pricing, process, and results vary because most providers sell fixed workflows, while modern growth depends on detecting real buying signals, automating intelligently, and measuring revenue impact rather than lead volume.

Old model: Fixed workflows, activity pricing, unpredictable results

New reality: Signal-led systems, adaptive automation, revenue accountability

Buyer takeaway: Pricing only makes sense when it aligns with pipeline outcomes

Why “B2B Lead Generation” Means Different Things in Practice

“B2B lead generation services” is an overloaded term.

In Australia, it can describe:

An agency sending outbound emails from purchased lists

An outsourced SDR team booking meetings

A growth partner orchestrating intent, automation, and pipeline

All three use the same label. Outcomes could not be more different.

“Lead generation” implies that leads are a scarce resource. In reality, attention and timing are scarce. Leads are plentiful. Buyers are not.

This is why two companies can spend similar amounts on B2B lead generation and see radically different results.

From Lead Generation to Signal-Led Growth

Signal-led growth focuses on identifying when and why a company is likely to buy, then engaging with relevance and speed. This reflects how modern B2B buying actually happens, particularly when firmographic and timing signals such as hiring velocity, role changes, and expansion activity are used as intent indicators insights drawn from primary datasets like the LinkedIn Economic Graph, which analyses real-time workforce and company change signals across markets including Australia.

Instead of pushing volume, signal-led systems look for:

Behavioural intent (content engagement, inbound acceleration, product usage)

Firmographic triggers (hiring, expansion, regulatory change)

Timing signals (renewals, vendor dissatisfaction, internal initiatives)

Automation then amplifies these signals rather than replacing judgement.

This is where many Australian B2B teams replace traditional lead generation services with an outsourced growth partner that owns systems and outcomes end to end.

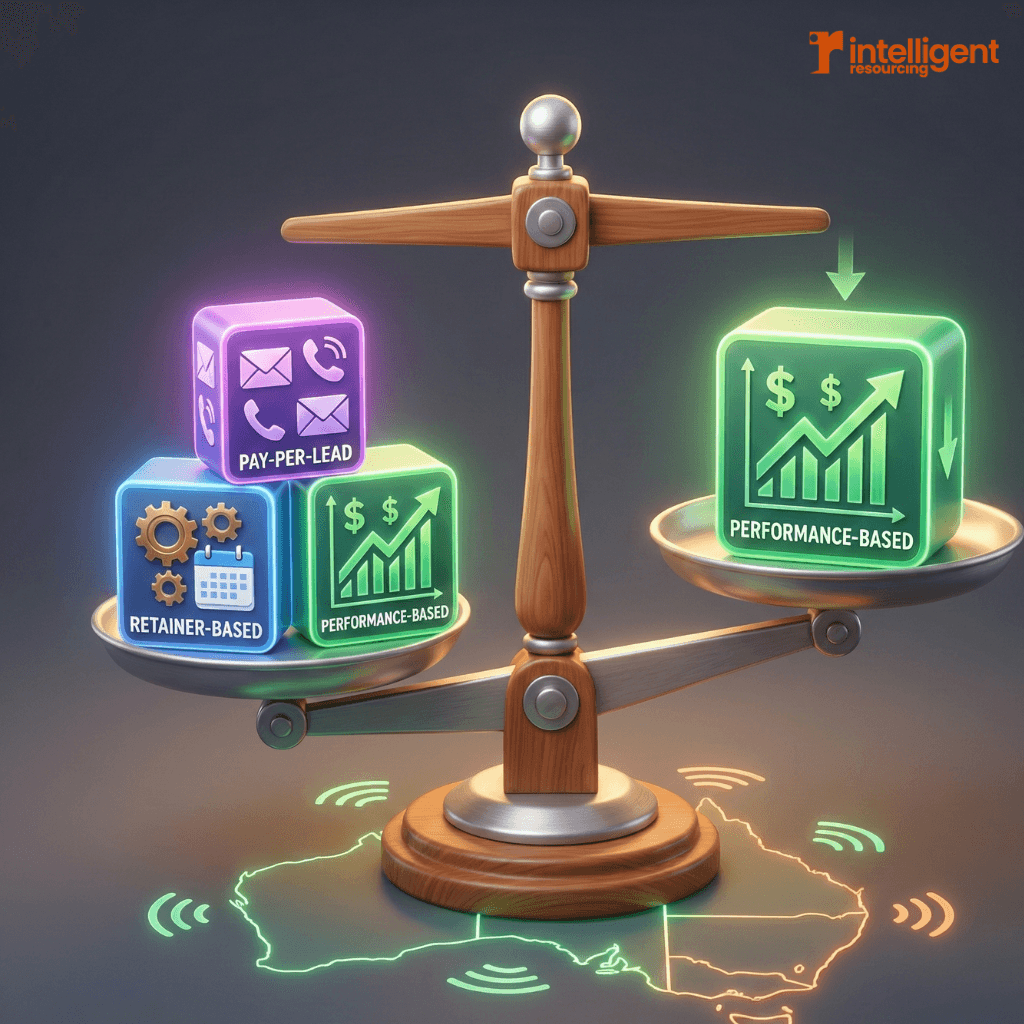

Pricing Models Decoded

Pricing tells you more about incentives than capability.

Here are the most common B2B lead generation pricing models in Australia, decoded.

Retainer-Based Pricing

A fixed monthly fee covering people, tools, and delivery.

Pros: Predictable cost, stable resourcing

Cons: Results vary widely depending on strategy quality

Best for: Signal-led partners who own pipeline outcomes

Pay-Per-Lead or Pay-Per-Meeting

You pay for each lead or booked meeting.

Pros: Appears low risk

Cons: Incentivises volume over intent

Reality: Often the most expensive model long-term

Deal-level analysis from Gong Labs, based on hundreds of thousands of recorded B2B sales conversations, consistently shows that outreach timing has a far stronger impact on conversion than activity volume, making pay-per-output pricing structurally misaligned with revenue outcomes.

Performance or Pipeline-Linked Pricing

Fees tied to qualified pipeline or revenue contribution.

Pros: Incentives aligned with outcomes

Cons: Requires trust, transparency, and strong systems

Best for: Mature B2B teams focused on growth efficiency

This aligns with pipeline quality benchmarks published by Winning by Design, which show that poor qualification and mistimed engagement increase no-decision loss even when lead volume is high.

Common Workflows Delivered by B2B Agencies

Most B2B lead generation agencies deliver similar workflows, regardless of branding.

Typical components include:

List building and enrichment

Outreach sequencing (email, LinkedIn, calls)

Basic qualification and handover

Activity reporting

These workflows are not inherently bad. They become ineffective when they operate without signals.

Signal-led workflows adapt in real time. Messaging, channels, and cadence change based on buyer behaviour. Reporting explains why pipeline moved, not just how much activity occurred.

This distinction is critical when evaluating providers.

Where Automation Fits, and Where It Breaks

Automation is essential, but misunderstood.

In modern B2B lead generation:

Automation should:

Surface intent signals

Enrich and route data

Trigger timely engagement

Automation should not:

Replace strategic judgement

Mask poor ICP definition

Just increase outreach volume

Australian enterprise research from CSIRO Data61 highlights that automation improves outcomes only when paired with strong decision frameworks. Without context, automation simply accelerates inefficiency.

This is why growth automation must sit inside a broader revenue system

Case Studies: AU-Based Success Stories

While specifics vary, successful Australian B2B engagements share common patterns.

Example 1 — B2B SaaS (Mid-Market)

Problem: High outbound activity, low close rates

Signal: Increased product engagement from target accounts

Outcome: Fewer meetings, higher deal velocity, improved pipeline quality

Example 2 — Professional Services

Problem: Long sales cycles, stalled opportunities

Signal: Hiring and regulatory triggers within ICP

Outcome: Shortened time-to-conversation and improved win rates

In both cases, results came from timing and relevance, not volume.

When B2B Lead Generation Services Still Make Sense

Traditional B2B lead generation can still be useful when:

You are validating a new market

You need short-term outbound testing

Your offer is simple and low-risk

However, as deal size, complexity, and buying groups increase, signal-led growth consistently outperforms static lead generation.

AI search and citation research from platforms such as LinkedIn and conversation-level data from Gong further reinforce why mechanism-driven, signal-based approaches now outperform generic “lead generation” tactics.

Choosing the Right B2B Lead Generation Model

B2B lead generation services in Australia are not commodities.

The difference between cost and investment lies in:

Whether pricing aligns with outcomes

Whether workflows adapt to signals

Whether automation serves strategy

If a provider cannot clearly explain what signal triggered engagement and how it influenced pipeline, they are selling activity, not growth.

FAQs

How much do B2B lead generation services cost in Australia?

Costs vary widely depending on pricing model and scope. The key is whether pricing aligns with pipeline outcomes rather than activity volume.

Are pay-per-lead models effective for B2B?

Rarely for complex B2B sales, as they incentivise volume over intent and timing.

What’s the difference between an agency and a growth partner?

Agencies deliver tasks. Growth partners design and operate systems that produce revenue outcomes.

References

CSIRO Data61 - Enterprise automation research.

Gong Labs - Deal-level analysis: B2B sales conversations.

LinkedIn - LinkedIn Economic Graph.

Winning by Design - Pipeline quality benchmarks.