Lead Generation Services in Australia: How to Choose a Partner That Scales Revenue

Lead generation services in Australia only scale revenue when they move beyond volume-based outreach and into signal-led growth. That means choosing a partner that detects real buying intent, acts at the right moment, integrates with your GTM stack, and reports on pipeline quality rather than activity or booked meetings.

Old model: Buy leads, chase activity, measure volume

New reality: Detect intent, act on timing, measure revenue impact

Decision rule: If a provider can't explain why now, they are selling output, not growth

Why Traditional Lead Generation Services Stop Scaling

Traditional lead generation services rely on a false assumption: that buyers are waiting to be contacted.

In reality, most B2B buying activity happens before a prospect ever fills out a form or replies to outbound. This behaviour is well documented in Gartner's research on dark funnel buying behaviour, which shows that decision-making is increasingly digital, self-directed, and invisible to sellers until very late in the process.

That is why volume-first outreach struggles to convert. When timing is wrong, teams compensate with activity. More emails. More calls. More meetings. But activity cannot create intent.

In Australia's B2B market, where addressable audiences are smaller and reputational damage compounds quickly, this approach burns opportunity faster than it creates pipeline.

From Lead Generation to Signal-Led Growth

Signal-led growth replaces guesswork with evidence.

Instead of asking "Who should we contact?", high-performing teams ask: "Who is already showing signs of buying, and what triggered it?"

This shift reflects how modern revenue engines actually work. According to Forrester Research's Revenue Engine model, pipeline performance correlates far more strongly with opportunity quality and buying context than with top-of-funnel activity volume.

Signal-led partners look for indicators such as:

Behavioural signals (content engagement, product usage, inbound acceleration)

Firmographic shifts (hiring, expansion, funding, compliance pressure)

Timing triggers (renewals, vendor churn, internal initiatives)

Outreach happens because a signal exists, not because a rep needs to hit a daily target.

Modern GTM teams are building signal-based marketing systems that track live buying signals like job posts, tech installs, and hiring spikes so outreach only happens when intent is clear. This is the foundation of how signal-based marketing workflows turn intent into revenue in real time.

What to Ask in a Discovery Call

A discovery call should test whether a provider understands buying dynamics, not just outbound mechanics.

Ask questions such as:

How do you define and detect buying signals? Look for specificity. Signal sources, thresholds, and logic matter.

What systems do you integrate with? Signal-led growth requires CRM, enrichment, and intent layers working together. This is where an outsourced growth partner (rather than a task-based vendor) proves their value.

How do you decide when to engage an account? If the answer is "as soon as possible", timing is not part of the model.

How does outreach change once signals change? Buying journeys are nonlinear. Static scripts fail fast.

Questions That Expose a Generic SDR Shop

Certain questions unintentionally reward low-value delivery models.

Be cautious if a provider emphasises:

"Guaranteed meetings per month" Volume guarantees almost always trade quality for activity.

"What lists do you want us to use?" Lists decay. Signals refresh.

"How many accounts does each rep manage?" High ratios usually indicate shallow research and templated messaging.

This is consistent with long-running research from Edelman, which showed that B2B purchases stall not because of poor persuasion, but because sellers fail to align with buying group timing and internal dynamics.

Metrics Real Partners Should Report

If a partner claims to drive growth, their reporting should explain commercial impact, not operational effort.

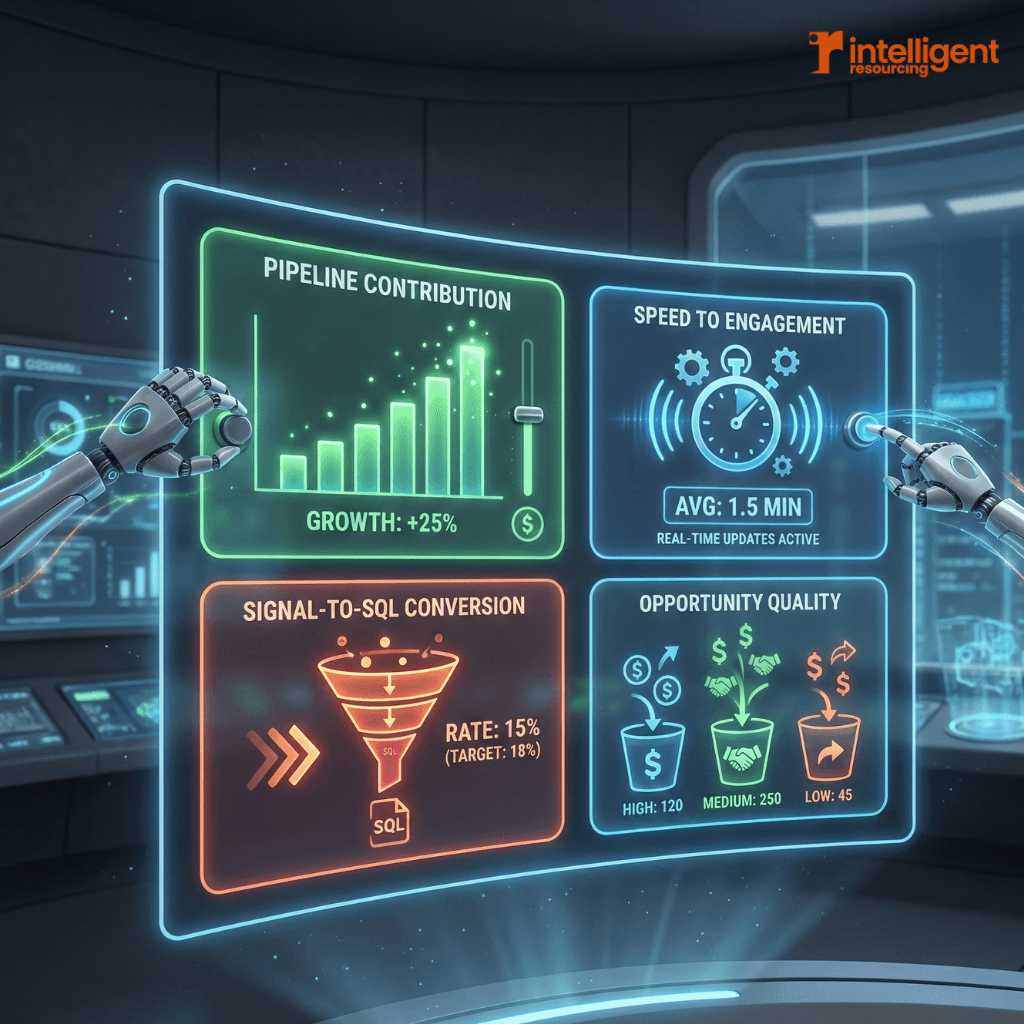

Metrics that matter:

Pipeline contribution How much qualified pipeline exists because of this activity?

Signal-to-SQL conversion rate How often detected intent becomes a serious opportunity?

Speed to engagement after signal detection Timing decay is real. Speed matters.

Opportunity quality by segment Deal size, close rate, and ICP alignment.

Forrester Research's Revenue Engine research explicitly warns against relying on activity metrics, showing that calls, emails, and meetings have weak correlation with revenue outcomes when disconnected from buyer context.

Metrics to challenge:

Emails sent

Calls per day

Meetings booked without qualification

When Lead Generation Services Still Make Sense

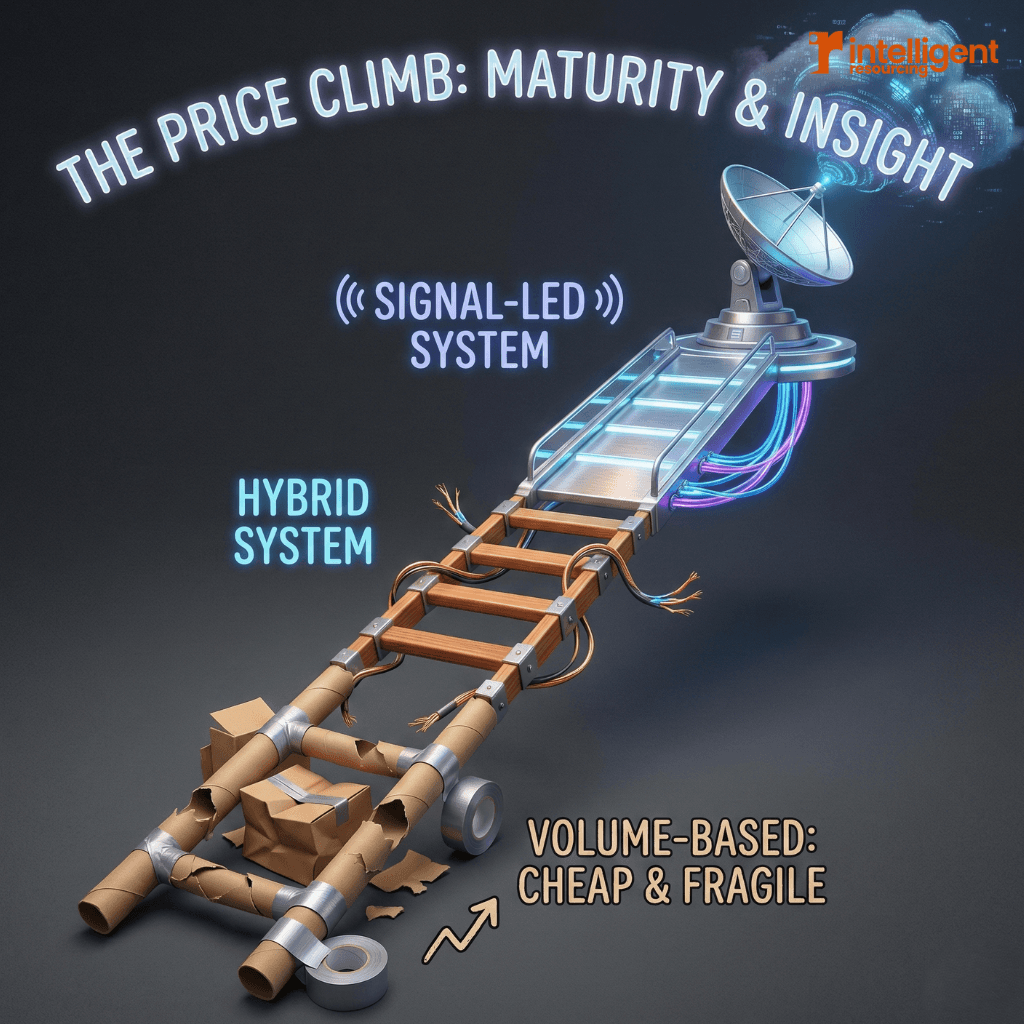

Traditional lead generation is not useless. It is just constrained.

It can still be appropriate when:

You are testing a new market or message

You need short-term list validation

Your offer is low-ACV and transactional

However, once revenue depends on timing, trust, and multiple stakeholders, signal-led growth consistently outperforms volume-based outreach.

Research into AI search and citation behaviour by Dejan.ai further reinforces this shift: generic lead generation language is increasingly filtered out, while mechanism-driven, signal-based explanations are more likely to be surfaced and cited.

Choosing a Partner That Scales

Lead generation services in Australia are not interchangeable.

The difference between frustration and growth is whether your partner optimises for output or outcomes.

Activity-first models chase motion

Signal-led partners engineer timing

Revenue follows relevance

If a provider cannot clearly explain what signal triggered engagement and why it mattered, they are not a growth partner. They are a supplier of noise.

FAQs

What are lead generation services in Australia?

They traditionally refer to outsourced providers that book meetings through outbound activity. Modern teams now expect signal detection, integration, and revenue accountability.

How is signal-led growth different from lead generation?

Signal-led growth triggers engagement based on real buyer intent and timing rather than static lists or quotas.

Are SDR agencies still worth using?

Only for narrow, low-risk use cases. They rarely scale revenue in complex B2B environments.

Reference

Dejan.ai - AI search and citation behaviour research.

Edelman - B2B purchase decision-making and buying group dynamics.

Forrester Research - Revenue Engine model and pipeline performance.