Not all buyer intent signals are created equal. Some indicate genuine buying readiness, such as demo requests or repeat visits to pricing pages, while others, like a single email open or a generic content download, offer little more than surface interest. Many go-to-market teams still waste valuable effort chasing weak signals that don’t convert. In this article, you’ll learn which intent signals truly matter, how to distinguish between interest and readiness, and how to track and operationalise these signals across your stack to drive better results.

Why Identifying the Right Intent Signals Matters

The risk of acting on noise or vanity metrics

Plenty of teams are drowning in activity alerts, webinar lists, and click metrics that don’t translate into closed deals. These vanity indicators might make dashboards look busy, but they rarely connect with actual intent. Tracking everything equally leads to poor prioritisation and wastes SDR time on accounts that are not ready.

Why real intent is behavioural, not just topical

True buying intent is reflected through behaviour. Someone reading a blog post about industry trends isn’t the same as a user repeatedly returning to your pricing page or requesting a demo. The key difference is whether the behaviour reflects research, comparison, or decision-making. Topic relevance alone does not equal buying readiness.

The difference between interest and buying readiness

Many tools can surface signals of interest, like topic surges or ad clicks, but those need to be viewed in context. Buying readiness shows itself through patterns such as repeat high-intent visits, sudden engagement from decision-makers, or shifts in installed technology. Identifying where interest tips into intent is where effective GTM strategies begin.

The Strongest B2B Intent Signals Today

1st-party: Product page visits, demo requests, return frequency

Your own web analytics and form fills reveal the clearest intent. Someone who:

Returns to your demo page three times in a week

Views pricing or case studies

Submits a high-context form (e.g. “Talk to sales”)

...is signalling they’re actively considering your solution. These are direct indicators and should be prioritised heavily.

3rd-party: Topic surges, technology install changes, job posts

Third-party data enriches your view, especially when buyers aren’t engaging with your own content yet. Examples include:

Surge data from platforms like Bombora or G2

Job listings that suggest planned initiatives (e.g. hiring a RevOps lead)

Tech install data showing a competitor has been removed or added

These signals are useful when aligned with firmographic filters or when layered into campaigns.

Social signals: LinkedIn engagement, competitor follows, public mentions

Social behaviour, though sometimes overlooked, can be highly telling. Track:

When a key account starts liking competitor content

Public job changes that affect buying roles

Mentions or shares involving your brand or topic

These should be treated as valid inputs into both tracking and outreach, especially when social intent is tracked as part of the same model.

Weak Signals That Often Lead to False Positives

Newsletter opens and webinar sign-ups (without context)

Someone attending a webinar may be there for general insight rather than buying. Similarly, opening a newsletter or downloading a whitepaper doesn’t automatically mean intent. Unless these signals are followed by stronger engagement, like return visits or a contact request, they should not trigger handoffs.

Page bounces or shallow content views

A high bounce rate on product pages might seem like interest at a glance. But without scroll depth, time on page, or follow-up visits, these interactions are more noise than insight. Shallow sessions often indicate poor-fit traffic or accidental clicks.

Generic topic interest without buying behaviour

Interest in a trend or market topic does not necessarily signal solution interest. An executive reading about “data privacy” might not be looking for your SaaS tool. Always assess whether the topic aligns with the specific need your product solves, and whether follow-up activity supports buying behaviour.

How to Track Intent Signals Across Your Stack

Tracking requirements by signal type

Each signal type comes with its own capture method. For example:

1st-party data requires solid event tracking and attribution models

3rd-party intent needs integrations with enrichment vendors

Social data often demands scraping, APIs, or dedicated tools

Before doing anything with signals, make sure your stack can capture them accurately.

Aligning CRM fields, web events, and third-party data

One of the most common reasons signals don’t convert is poor data flow. You need:

CRM fields that store intent type, strength, and date

Mapped web events that assign values to actions

Fields for third-party attributes (like surge scores or install dates)

None of this matters without solid tracking foundations. If your systems don’t align, you won’t be able to score or act on the data.

Tools and integrations that reduce manual effort

The best signal systems reduce effort, not increase it. Look for:

Web analytics tools with behavioural scoring (e.g. Clearbit, Segment)

CRM connectors (e.g. Salesforce + 6sense)

Social monitoring tools that capture signals without screenshotting LinkedIn

The goal is to make sure that social behaviour is captured automatically and that nothing relies on manual updates or list uploads.

Turning Signals Into Action: Scoring, Routing, Campaigns

Feeding signals into lead and account scoring models

Once signals are flowing in, you need to weigh them. Not all visits or surges mean the same thing. For example:

Demo request = 100 points

Tech uninstall = 60 points

Topic surge + page return = 40 points

Use thresholds to determine hand-off and prioritisation, and only once you are ready to convert these signals into a score.

Triggering automated plays from tracked signals

Signals should lead to action. For example:

Send an SDR alert when a high-fit account hits the pricing page three times

Trigger email nurture when a user engages with two solution pages

Launch ads when job changes indicate potential opportunity

Do this once you are ready to turn signals into live plays, not just static MQL lists.

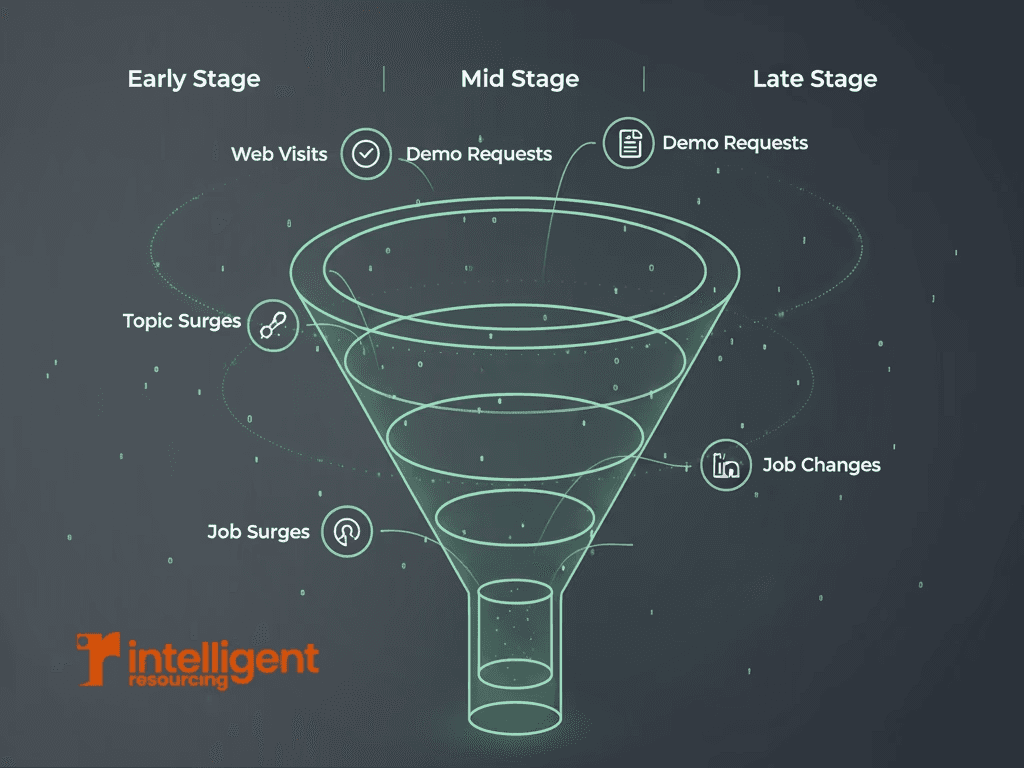

Segmenting by intent stage and readiness

Not all intent is equal. Use tiers like:

Warm interest: Blog visits, social follows

Mid-intent: Product comparison, pricing views

High-intent: Demo request, decision-maker engagement

These can be grouped into early, mid and late stage triggers, helping you tailor messaging and outreach.

Mapping Signals to the Buying Journey

Early-stage: Awareness, curiosity, research signals

At this stage, look for:

Visits to educational blog content

Social engagement with industry trends

Topic interest spikes (without product views)

These are useful for marketing nurture and content-based plays, but not for SDR follow-up.

Mid-stage: Solution comparison and product interest

Now the behaviour shifts:

Competitor comparisons

Case study downloads

Reviews on G2 or TrustRadius

These signals should feed campaign targeting and begin surfacing in sales dashboards.

Late-stage: Decision and purchase triggers

This is where buyers show intent through:

Demo bookings

Multiple decision-makers on your site

Purchase decision roles being hired

Signals should be mapped against the stages of how your buyers actually make decisions, not generic funnel terms.

Only Track What You’ll Act On

Intent signals are only valuable if you act on them. Many teams track too much, without clarity on how or when to use the data. Focus only on signals that:

Are trackable with your current stack

Clearly connect to buyer behaviour

Trigger meaningful actions

And remember, if your data foundations cannot support reliable signal capture, the effort won’t lead to revenue. This works best when your events, fields and identifiers are actually in order, and so these signals can drive real-time workflows rather than static lists.

FAQs

What is the difference between buyer interest and buyer intent?

Interest often reflects general curiosity, while intent shows active steps toward a purchase. A blog reader might be interested, but a pricing page visitor is showing intent.

Are third-party intent tools reliable?

They can be, but only when integrated with strong internal tracking. Look for consistent patterns, not isolated events, and always validate with your own data.

How should social signals be tracked?

By wiring them into your tracking stack via APIs or integrations. This avoids manual work and ensures signals are tracked as part of the same model.

What are some weak intent signals to avoid acting on?

Single newsletter opens, shallow bounces, or webinar sign-ups with no follow-up behaviour. These rarely convert on their own.

When should intent signals trigger automated workflows?

Once you are ready to turn signals into live plays, such as email sequences or SDR outreach, based on thresholds and scoring models.

How do I align signals with the buying journey stages?

Use clear intent categories, awareness, comparison, decision, and map signals like blog visits, competitor interest, or demo requests against the buying path.