How It Works in 2026

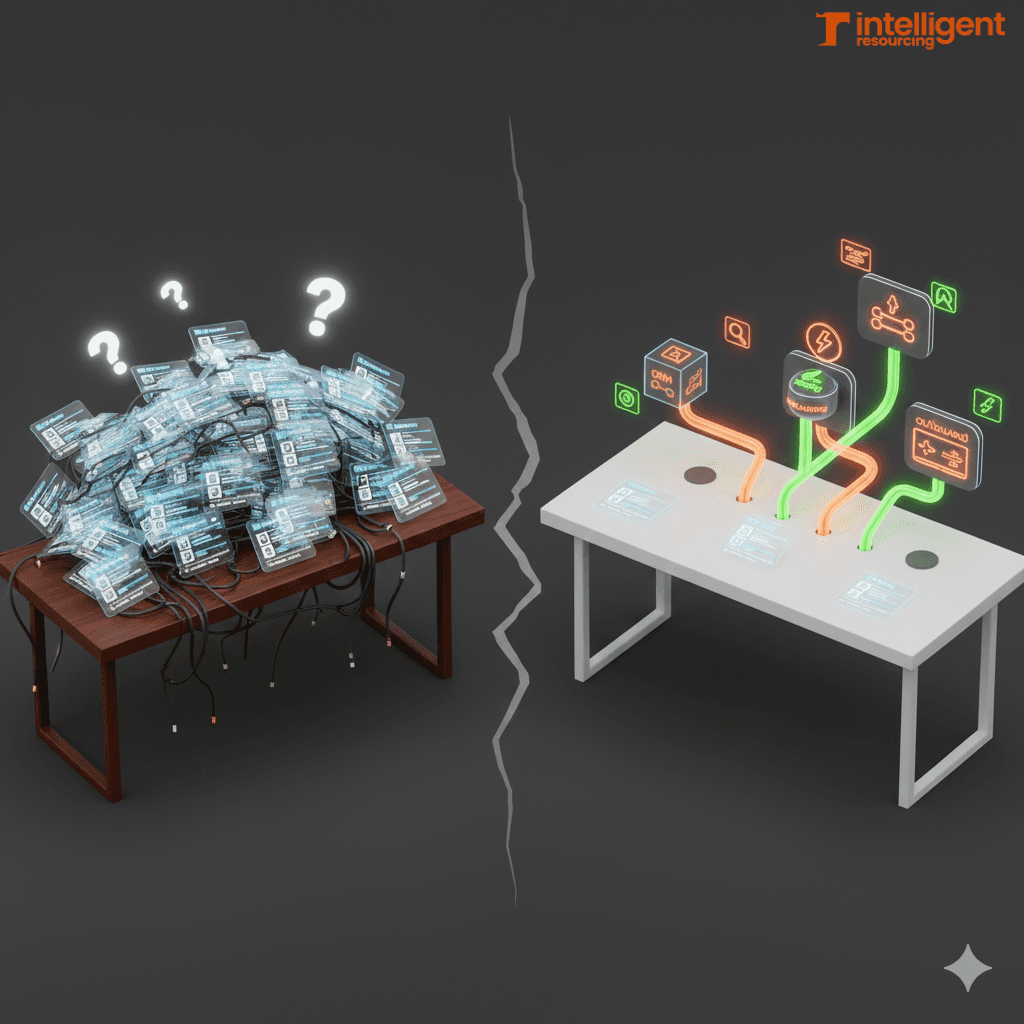

Most teams don't have a "data problem". They have a GTM brain problem.

The symptoms are familiar:

CRM records are half-complete or wrong

Every report comes with "but the data isn't quite right…"

Sales complain about bad lists

Marketing complain about bad targeting

RevOps is stuck cleaning instead of engineering

Then Clay shows up promising multi-source enrichment, AI research, and waterfall logic. Vendors like SMARTe plug in with millions of verified contacts and high mobile coverage.

The story becomes: "If we add Clay + a good data provider, our GTM problems are solved."

Sometimes you do get a lift. But in most organisations, better enrichment alone just creates better-decorated chaos.

At Intelligent Resourcing, we see Clay enrichment very differently: It's not a "nice to have". It's the foundation of your GTM operating system – if you design and resource it properly.

This article will walk through:

What Clay enrichment actually is (beyond the marketing)

Why "more data" by itself doesn't fix GTM

How to treat Clay as your GTM intelligence layer

Where vendors like SMARTe fit in (and where they don't)

And how we use Intelligent Resourcing to turn enrichment into a living, evolving GTM brain

What Clay Data Enrichment Actually Is in 2026

Let's strip it back.

From Single-Source Data to a Multi-Source GTM Brain

Traditional data tools look like this:

You sign a contract with a vendor

You accept whatever coverage and freshness they have

You live inside their interface and pray they're good in your ICP

Clay flips that model.

Instead of being a data provider, Clay is a data and workflow hub:

It connects to dozens of data sources – vendors like SMARTe, ZoomInfo, Clearbit, People Data Labs, and niche specialists

It lets you sequence them in waterfalls (cheap → premium, broad → niche)

It adds AI research on top – web scraping, pattern matching, custom logic

It gives you a flexible workspace where you decide what a "good record" means

Research shows that Clay's waterfall enrichment methodology typically achieves 80%+ match rates for email discovery, significantly higher than single-source alternatives that often plateau around 40-50%.

That changes the question from: "Which vendor has the best data?" to: "How do we design a GTM intelligence layer that orchestrates the right sources at the right time for our market?"

The Layers of Data That Matter

Clay can enrich records across multiple dimensions:

Firmographic:

Industry, size, revenue, location, ownership type

Used for ICP definition, segmenting, and routing

Technographic:

CRM, MAP, cloud providers, product categories in use

Used for competitor targeting, ecosystem plays, product fit

Demographic / Persona:

Role, seniority, department, region

Used for persona mapping, messaging, and multi-threading

Contact Data:

Verified emails, direct dials, social profiles

Used for actually reaching humans instead of bouncing into the void

Intent & Triggers:

Job changes, hiring patterns, funding rounds, tech changes, news

Used for timing – who to talk to now

Custom Fields:

ICP flags, lifecycle stages, scores, play tags

Used to anchor enrichment in your GTM logic, not a vendor's defaults

On paper, this sounds like "amazing, more data". In reality, it raises a harder question: "If we had all of this enriched, who would use it, how, and for what GTM decisions?"

That's where most teams fall down.

Why Better Enrichment Alone Doesn't Fix GTM

If the answer was just "buy Clay, plug in a good provider, done", our jobs as GTM leaders would be very easy. We all know it's not.

The Limits of "More Complete Records"

According to recent industry research, B2B data decays at rates between 22.5% and 70.3% annually, with email decay accelerating to 3.6% monthly. This means nearly three-quarters of prospect databases become outdated within 12 months.

We've seen plenty of CRMs where:

Every account has industry, size, revenue, tech stack

Every contact has role, seniority, LinkedIn, email, phone

Every row sparkles with tags and fields

And yet:

The sales team still chase the wrong accounts

Marketing still struggles to target and personalise effectively

Leadership still can't get a clear view of TAM, coverage, or pipeline quality

Why? Because enrichment is being treated as a cosmetic upgrade, not as the:

Source of truth for who we care about

Input for scoring, routing, and territory design

Backbone of signal-led GTM plays

Common Failure Modes We See

Some recurring patterns:

No real data model:

Fields are added ad hoc

No clear definitions or documentation

Nobody can explain why a certain combination of fields matters

No GTM architecture:

Enrichment is "turned on" but not embedded into:

Lead scoring

Account prioritisation

Multi-threading strategy

ABM program design

No operational ownership:

Everyone complains about data quality

Nobody owns:

Dedupe and merges

Enrichment schedules

Vendor mix and waterfalls

Monitoring and QA

Industry data reveals that poor data quality costs U.S. businesses $3.1 trillion annually, with individual organisations losing $12.9 to $15 million per year through wasted marketing spend, lost sales opportunities, and operational inefficiencies.

The result: Clay enrichment is technically "working". But strategically it's not powering a GTM operating system. It's just… data.

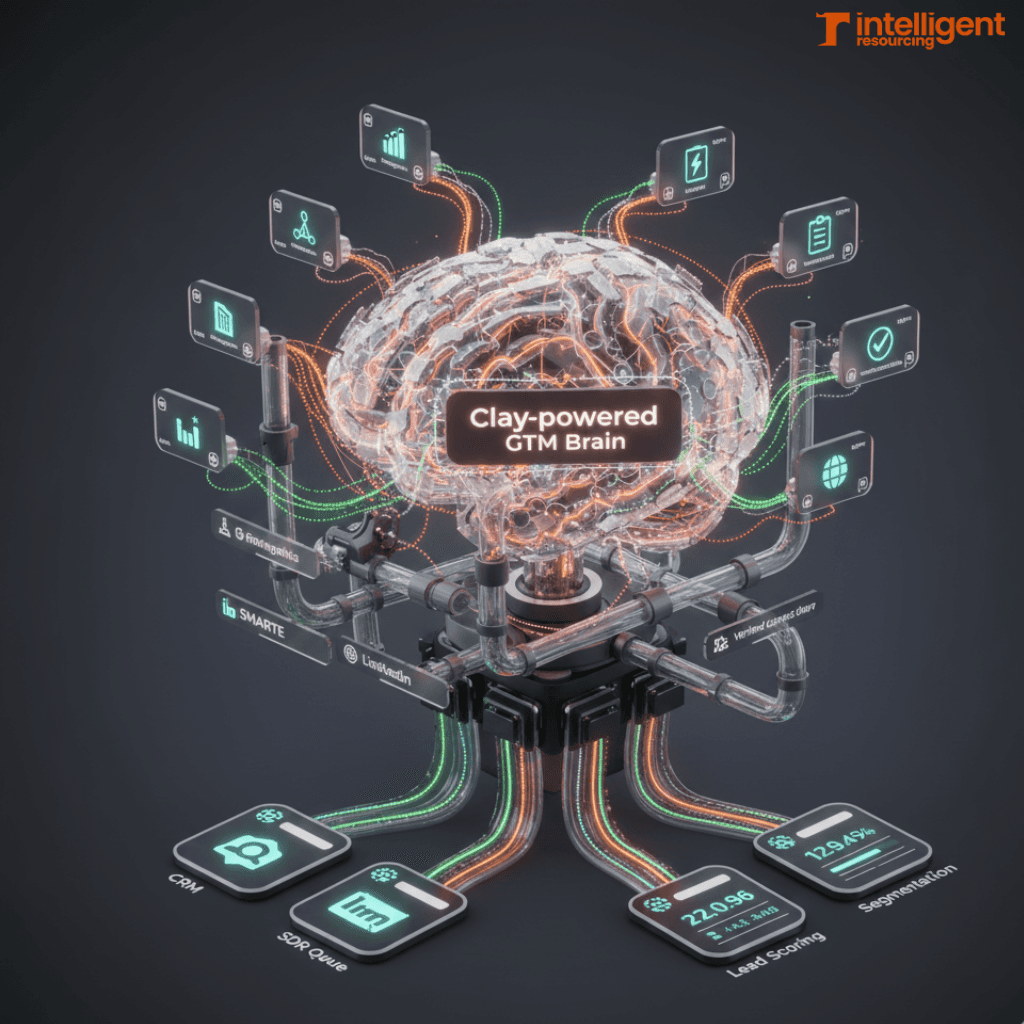

Clay Enrichment as the GTM Intelligence Layer

To make Clay actually transformative, you have to design for it.

At Intelligent Resourcing, this is where we start.

Designing the Right Data Model (Before You Touch Any Vendors)

We begin by asking questions that look suspiciously like business strategy, not tooling:

What are your core GTM motions? Outbound? Inbound? PLG? Expansion? Channel?

How do you define ICPs and segments today?

Which signals correlate with better win rates, faster cycles, or higher ACV?

What decisions do SDRs, AEs, CSMs, and marketing struggle with right now?

Then we back our way into the data model:

Which firmographic fields are actually worth capturing?

Which technographic signals map to a real commercial hypothesis?

Which persona attributes matter for routing and messaging?

Which events and behaviors need to fire plays, not just populate columns?

Clay tables are then designed to reflect:

Accounts (companies you care about)

Contacts (the people who matter)

Signals and events (what they're doing, changing, or buying)

States (ICP fit, intent level, lifecycle, play assignment)

Now enrichment isn't just "adding fields". It's feeding the GTM intelligence layer you run your business on.

Waterfalls, Signals, and Cost Control

Clay's multi-provider model is powerful, but only if you're intentional.

We design enrichment waterfalls that:

Use low-cost / broad providers first where coverage is fine

Reserve premium sources for:

Strategic segments

High-intent accounts

Missing but critical fields

Then we:

Blend vendor signals (e.g. SMARTe's direct dials and contact graph) with:

First-party data (product usage, web visits)

Public web signals (news, job posts, tech changes)

Express those as plays:

"New Head of Sales hired at ICP account"

"Existing customer adopted key adjacent tech"

"Prospect company raised a Series B and is hiring your ICP persona"

Studies show that clean data drives 20% better campaign response rates, 15% higher close rates within six months, and 12% increased conversion rates.

Data stops being something you "have". It becomes something that tells you what to do next.

Where Vendors Like SMARTe Fit – and Where They Don't

SMARTe (and similar providers) deserve credit. They solve hard problems:

Big, verified B2B contact graphs

High direct-dial coverage

Regularly refreshed data

Plugging SMARTe into Clay gives you:

Stronger phone and contact coverage

Better hit rates on decision-maker details

More reliable outbound lists when phone is a core motion

That's useful. But even the best vendor is still just: An ingredient in the GTM brain, not the brain itself.

Relying on SMARTe (or anyone else) without a system around it leads to:

Over-enrichment (costly and unnecessary)

Under-thinking (treating all contacts as equal)

Overconfidence ("we have great data" without great usage)

Our stance:

Vendors matter.

Your enrichment strategy, Clay architecture, and operational model matter more.

Turning Clay Enrichment into a Revenue Engine with Intelligent Resourcing

So how do we do this in practice?

Step 1 – GTM & Data Architecture

We start in strategy, not in settings.

Together we:

Map your GTM motions

Define ICPs and segments in a way that your sales team actually recognises

Identify high-value signals at each stage of the funnel

Decide what "great enrichment" means for your context

Then we design:

Clay tables and relationships

Field definitions and naming standards

Waterfall logic for each segment or motion

Where Clay should be the source of truth vs where it mirrors the CRM

You come away with a GTM intelligence blueprint, not just "we turned on some providers".

Step 2 – Clay as a GTM Brain, Not a Utility

Next, we implement:

Enrichment workflows:

Initial bulk clean-up

Ongoing, scheduled refresh

Event-driven enrichment for key plays

Downstream logic:

Scoring based on fit + intent

Assignment and routing rules

Play tags and campaign mapping

Integrations:

CRM (Salesforce, HubSpot, etc.)

Engagement tools (email, dialers, LinkedIn tools)

Marketing automation / CDPs

The goal: whenever new or updated data hits, the system reacts:

High-fit, high-intent → flagged and routed

Low-fit → filtered out or deprioritised

Changing context → new plays triggered

Clay becomes the brain that informs GTM decisions, not a siloed enrichment widget.

Step 3 – Embed an Enrichment & GTM Intelligence

This is where most teams get stuck – and where Intelligent Resourcing changes the game.

Data and signals are never done. They're living.

So we keep your GTM brain healthy. For example:

Clay / GTM engineer

Data & enrichment analysts

They:

Monitor enrichment runs and waterfalls

Tune provider mix based on performance and cost

Maintain data hygiene: dedupe, merges, parent/child structures

Curate and test new signals

Build small experiments (new segments, filters, scores)

Report insights back to RevOps and GTM leaders

Step 4 – Operationalise Through RevOps Routines

Finally, we wire this into the way your business actually runs:

Weekly:

Pipeline and signal reviews

SDR feedback on list quality and plays

Monthly:

Funnel health checks

Segment/ICP performance reviews

Waterfall and vendor tuning

Quarterly:

ICP and play refresh

Tech and tools alignment

New GTM motions designed into the Clay system

Enrichment becomes a muscle, not a project.

Is Your Team Ready for a Clay-Powered GTM Intelligence Layer?

You don't need Clay and a dozen vendors if:

You're small, early, and still guessing your ICP

Your primary problem is "we don't have any leads at all"

But you may be ready for this system-first approach if:

You're spending real money on data tools and frustrated with results

Your team constantly complains about list quality and CRM mess

You can't easily answer questions like:

"What proportion of our ICP have we actually touched?"

"Which signals predict opportunities most reliably?"

"Where are the biggest gaps in our TAM coverage?"

If that's you, the next move isn't: "Let's add another data provider."

It's: "Let's design a GTM brain, and give it a team."

Don't Stop at "Better Data". Build a Better GTM Brain.

Clay enrichment plus a strong vendor like SMARTe is a powerful combination. But it's not the final answer.

The real advantage comes when you:

Treat enrichment as the foundation of your GTM operating system

Design Clay as your GTM intelligence layer, not a side tool

Embed a team whose whole job is to keep that brain sharp, accurate, and aligned to revenue

That's what we do at Intelligent Resourcing:

We're an Ops Studio – we engineer GTM systems with Clay at the core.

We're an Intelligent Resourcing partner – we build and run those systems with you, every day.

If you're done buying "more data" and ready to build a GTM brain you actually trust, your next steps are simple:

Map your Clay-powered GTM intelligence layer with us

Not just enriched rows. A system and a team that turns enrichment into revenue.

Contact Intelligent Resourcing to get started.

Related Resources

Explore more insights from Intelligent Resourcing: