How to Choose a B2B Lead Generation Agency (Signal-First Checklist)

To choose a B2B lead generation agency in 2026, prioritise signal quality over lead volume. The right partner can explain where buying intent comes from, how it maps to a Verified Buying Window™, how it integrates with your CRM/automation, and what happens when assumptions fail. If they sell activity instead of decision logic, walk away.

• Signal beats volume (timing + relevance drives pipeline, not "more leads").

• Stack compatibility beats tools (Evergreen CRM > shiny outbound stack).

• Retainers often beat performance pricing in complex B2B (incentives matter).

Decision matrix (read this before any proposal)

What you're deciding: Primary optimisation

• Volume-first agency is "good for…": Hitting lead/meeting numbers

• Signal-first agency is "good for…": Improving decision accuracy + pipeline conversion

• Red flag to watch: "We guarantee X meetings" with no explanation of intent sources

What you're deciding: Targeting approach

• Volume-first agency is "good for…": Big lists + broad ICP

• Signal-first agency is "good for…": ICP enforcement + exclusion rules + intent cues

• Red flag to watch: No exclusion logic ("we can sell to anyone")

What you're deciding: Timing

• Volume-first agency is "good for…": Fixed sequences regardless of market timing

• Signal-first agency is "good for…": Verified Buying Window™ + triggers

• Red flag to watch: No view on when prospects buy

What you're deciding: Measurement

• Volume-first agency is "good for…": Opens, clicks, meetings set

• Signal-first agency is "good for…": Qualified pipeline, stage progression, cycle time

• Red flag to watch: Reporting stops at "activity delivered"

What you're deciding: Risk management

• Volume-first agency is "good for…": Blames market/copy

• Signal-first agency is "good for…": Names failure modes + mitigations

• Red flag to watch: Can't answer "what breaks first?"

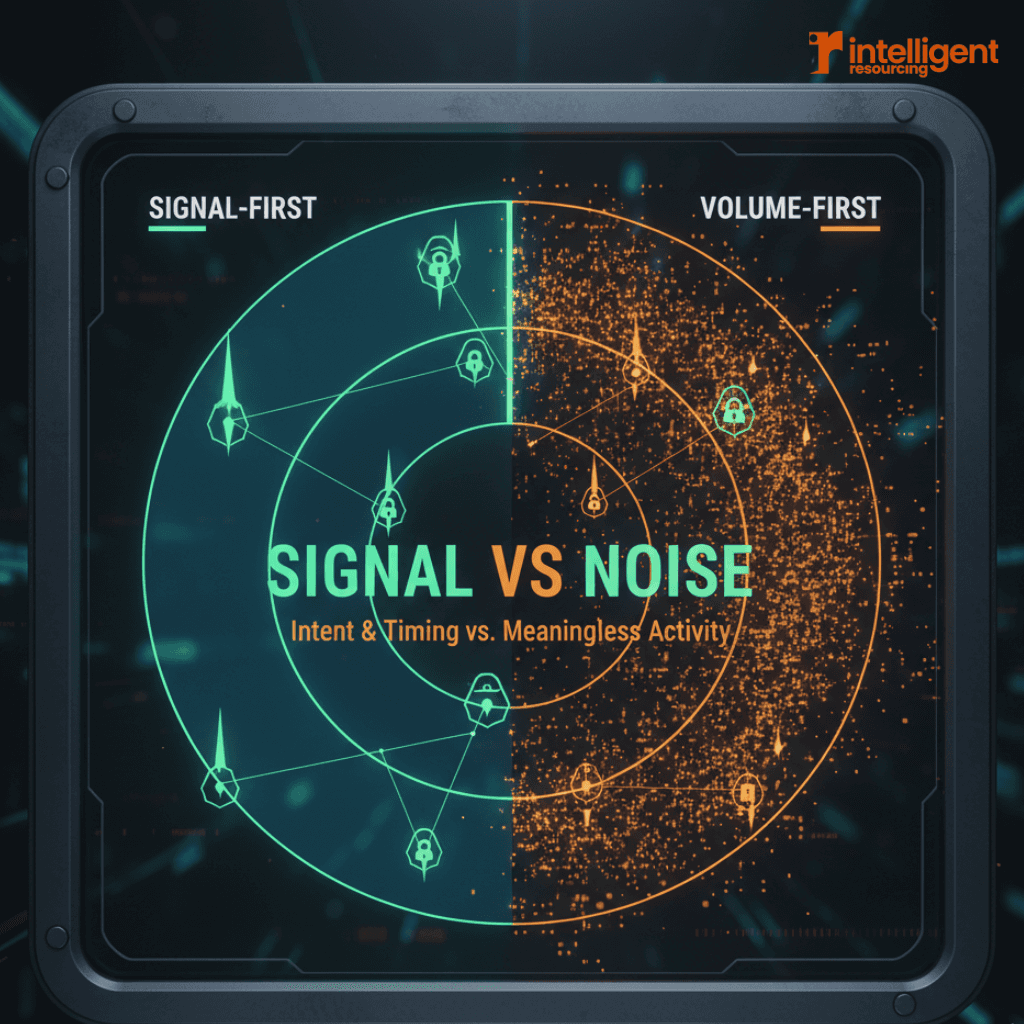

Signal-first vs volume-first agencies

How volume-first agencies optimise for delivery

Most "lead gen services" are built to ship outputs: a set number of leads, contacts, or meetings. That pushes them towards list scale, generic sequencing, and broad claims like "we do outbound + LinkedIn + ads". On paper, it looks comprehensive. In practice, incentives drift towards what's easiest to count.

A useful lens here is Goodhart's Law: "when a measure becomes a target, it ceases to be a good measure." If an agency is paid for meetings booked, you'll predictably get meetings, often with the wrong accounts, at the wrong time.

How signal-first agencies optimise for timing

Signal-first partners treat outbound as Signal Orchestration: a system that activates only when fit + timing are credible. They're less excited about sending volume and more obsessed with why this account, why now, via which channel, with what proof?

They also accept a modern constraint: buyers spend limited time with suppliers during a purchase journey, so timing mistakes compound quickly. Gartner has reported buyers spend only a small fraction of buying time meeting potential suppliers.

Why both can look identical in a proposal

Because proposals are often written as a capability menu ("we do SDR, email, LinkedIn, intent, ads"). The difference is whether the agency can show the decision logic behind those capabilities: the rules, thresholds, exclusions, and what they do when the signal goes quiet.

The signal-first checklist (buyer framework)

Use this as a shortlisting filter. The point is to identify whether the agency has a process, not just outputs.

Signal source clarity – where intent comes from

Ask: "What signals do you use, and which ones do you ignore?"

Look for: a clear hierarchy (e.g. first-party intent, product usage, category searches, competitor comparisons, job changes, funding, tech installs) and how each maps to outreach.

Red flag: vague claims like "we use intent data" without naming sources, reliability, or false positives.

Buying-window logic – how timing is determined

Ask: "How do you define and verify a buying window?"

Look for: triggers + disqualifiers + re-check cadence (eg. "we pause accounts with no corroboration after X days").

Red flag: a one-size sequence that runs regardless of context.

ICP enforcement – how exclusion is handled

Ask: "Show me your exclusion rules. What do you refuse to target?"

Look for: hard constraints (eg. size, region, compliance, sales motion mismatch) and a documented "no-go" list.

Red flag: "We'll test everyone" (translation: you'll pay for their learning).

Failure scenarios – what breaks first

Ask: "What fails first in week 2–4, and what do you change?"

Look for: named failure modes: data decay, offer/ICP mismatch, attribution loss, channel deliverability, SDR handoff, CRM hygiene.

Red flag: they can't name a single predictable failure mode.

Consensus check: "If you can't describe what you are doing as a process, you don't know what you're doing." — W. Edwards Deming

If the agency can't explain their process in plain steps, don't let them "run experiments" on your pipeline.

Tech stack compatibility (the most missed risk)

Signal-first delivery fails most often at the stack layer—where good intent gets destroyed by bad plumbing.

CRM survivability (Evergreen CRM)

Audit: field mapping, dedupe rules, lead/account ownership, lifecycle stages, contact role capture.

Failure mode: duplicated contacts and conflicting ownership that kills follow-up speed and attribution.

Marketing automation alignment

Audit: how outbound touches appear in HubSpot/Marketo/Pardot; suppression lists; opt-outs; lifecycle handoffs.

Failure mode: you "generate demand" but contaminate suppression lists, break lead scoring, or create compliance risk.

Data decay and attribution loss

Audit: enrichment cadence, bounce handling, job-change handling, and how meetings are attributed (source/medium, campaign, sequence ID).

Failure mode: after 60–90 days, reporting can't answer "what actually drove the pipeline?"

Compliance note (UK/AU): If you operate in the UK, B2B direct marketing still has rules and needs careful planning. In Australia, consent and unsubscribe requirements are explicit, and responsibility remains with you even if an agency sends the messages.

Retainer vs performance models (what pricing really signals)

Why pay-per-lead incentives fail

Pay-per-lead can reward low-friction conversions over qualified pipeline. It also encourages targeting anyone who might respond, not who might buy.

When retainers are safer

Retainers can be safer when:

• you need ICP learning + message-market fit refinement

• the sales cycle is long and qualification is nuanced

• attribution requires instrumentation (CRM + automation + intent)

Hybrid models and risk transfer

A sensible hybrid aligns on:

• a stable base retainer (delivery + systems)

• a quality gate (eg. ICP-verified meetings)

• a pipeline or stage-based kicker (not raw lead counts)

Questions you should ask before signing

• "What does success look like in 90 days?" (pipeline, stage movement, cycle time—not just meetings)

• "What signal do you not act on?" (tests discipline)

• "Show me your exclusion rules." (tests ICP enforcement)

• "What breaks first, and how do you detect it?" (tests failure awareness)

• "How does this land in our CRM?" (tests survivability)

Primary CTA: Pressure-test your current agency against a signal-first checklist.

FAQs

What should I look for in a B2B lead generation agency proposal?

Look for signal sources, buying-window logic, ICP exclusions, stack integration details, and failure-mode plans—not just activity volumes and channel lists.

Is pay-per-lead ever a good idea?

Only when qualification is simple and outcomes are easily validated. In complex B2B, it often misaligns incentives towards volume.

How quickly should a lead gen agency show results?

You should see instrumentation + ICP calibration early, then leading indicators (reply quality, stage entry, sales acceptance) before obsessing over meeting count.

Do agencies need access to our CRM?

If they can't integrate cleanly with your CRM and automation, you'll lose attribution and create operational risk. Limited, well-governed access is often necessary.

Related Resources

For more information on outsourced B2B lead generation, explore our comprehensive guide covering the Australian market.

Learn more about choosing the right outbound lead generation agencies for your business needs.

Understand different lead generation agency pricing models and what works best for your organisation.

Discover how signal-driven outbound automation can transform your lead generation strategy.

External References

• Gartner – The B2B Buying Journey

• Belkins – Cold Email Benchmarks

• Backlinko/Pitchbox – Outreach Study

• ICO – Direct Marketing Guidance (UK)

• ACMA – Spam Compliance (Australia)