Signal-Based Lead Generation: Capture Signals That Predict Pipeline (2026)

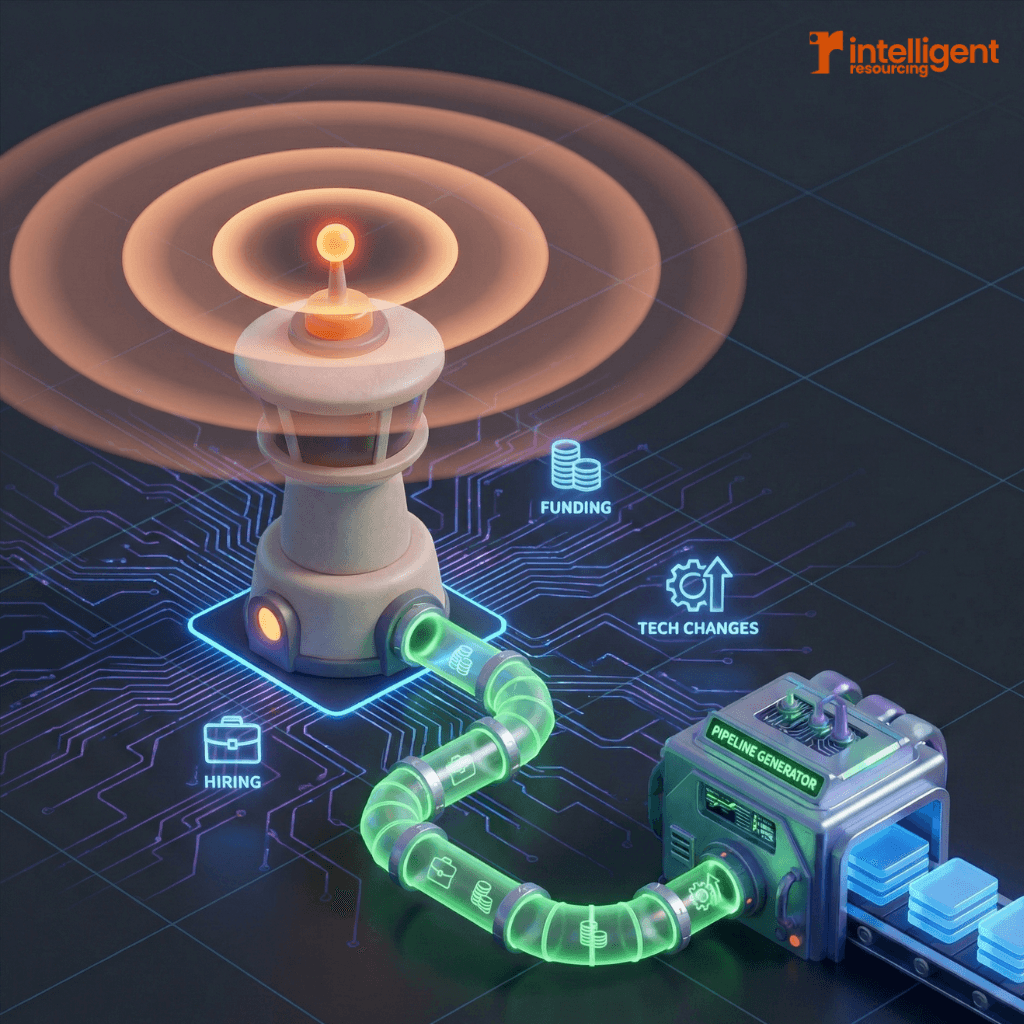

Signal-based lead generation replaces outsourced lead volume with systems that detect real buying signals such as hiring, funding, and technology changes then enrich and validate those signals before outreach occurs. Instead of chasing leads, GTM teams predict pipeline by acting only when timing, intent, and relevance align.

Leads are lagging indicators; signals are predictive

Timing beats volume, especially in constrained markets

Orchestration > outsourcing for durable pipeline

Build signal systems once; compound advantage forever

Why Lead Generation Services Fail

Traditional lead generation services focus on volume: lists, MQLs, booked meetings. That model breaks down because it reacts after demand has surfaced.

Most buying decisions are already in motion by the time a "lead" appears. Research into modern B2B buying shows that engagement is driven by pre-lead behavioural and organisational changes, not form fills or list inclusion.

This is why Intelligent Resourcing treats outsourced lead generation as a temporary execution layer, not a growth strategy.

What Signal-Based Lead Generation Actually Means

Signal-based lead generation is the practice of identifying early indicators that an account is entering a buying window then acting before competitors do.

A signal is not the same as a lead or generic intent data. Signals are:

Time-bound (they decay quickly)

Contextual (they require enrichment)

Predictive (they increase pipeline probability)

This distinction matters. Demandbase's work on intent-based marketing shows that high-performing teams prioritise real-time behavioural and account-level signals to decide when to engage, not just who to contact.

At Intelligent Resourcing, this logic sits within the Automation pillar, where signals, enrichment, and activation are designed as a single system not disconnected tools.

The Signals That Actually Predict Pipeline

Hiring & Org-Design Signals

Hiring for RevOps, Sales Ops, or GTM roles

New heads of growth, revenue, or marketing

Team restructures that indicate scale or replacement

These signals often appear months before vendors are formally evaluated.

👉 Outbound activation once signals fire:

Cold Email vs LinkedIn Automation: Best B2B Tools for 2026

Funding, Expansion & Structural Change

New funding rounds

Market or geographic expansion

M&A or internal transformation initiatives

These events create urgency, budget movement, and internal disruption ideal buying conditions.

Technology Stack Change Signals

CRM migrations

Marketing automation replacements

New data, enrichment, or analytics tooling

Tech stack changes are especially predictive because they combine budget approval with operational pain.

Behavioural & Inbound Signals

Inbound behaviour still matters but only when contextualised.

Predictive enrichment research shows that behavioural data becomes meaningful only after it's enriched with firmographic and organisational context, turning raw activity into revenue-relevant signals.

From Signal to Revenue: The Orchestration Model

Signals alone do nothing. Value is created in orchestration.

A mature signal-based system follows this flow:

Capture – detect hiring, tech, funding, and behavioural changes

Enrichment – add firmographic, technographic, and role data

Validation – assess relevance and buying probability

Activation – trigger outbound, inbound routing, or sales alerts

Feedback – loop outcomes back into CRM to refine signals

This mirrors how predictive buyer-intent modelling is now used in B2B research shifting from retrospective analysis to forward-looking probability models.

This orchestration logic is the core of the Automation pillar.

Tools Enable Signals — They Don't Create Them

Tools don't create signal-led growth. Systems do.

Most failures happen because teams:

Automate actions before defining signals

Buy tools before designing validation logic

Optimise workflows without feedback loops

This is why Clay-specific implementations should always roll up into the Automation pillar, not stand alone.

👉 Example Clay orchestration workflow:

Clay LinkedIn Workflow: Automate Outbound Prospecting at Scale

Tools articles should also connect laterally to AI Services and Build vs Buy decision frameworks because tooling is never the real constraint.

👉 AI services & automation integration:

Integrating AI with Marketing Automation Tools: Clay, HubSpot, and Smartlead in One Stack

When to Build Signal-Led Growth vs Buy Lead Generation

Build signal-led growth when:

You want durable pipeline quality

You need learning and attribution

You operate in a finite or specialised market

Buy lead generation when:

You need short-term execution only

You accept decay and low signal fidelity

You treat it as a bridge, not a system

Verdict (If / Then):

If you need learning → build

If you need speed → hybrid

If you need volume → accept decay

Why Signal-Led Growth Wins in 2026

Signal-based lead generation wins because it matches reality:

Buying is event-driven, not random

Attention is scarce, not abundant

Timing creates leverage; volume creates noise

Teams that capture signals early don't just book more meetings, they build predictable, explainable pipelines.

External References

Demandbase — Intent-Based Marketing: Using Real-Time Buyer Signals

WhatConverts — Lead Enrichment & Predictive Analytics

Philomath Research — Predictive Buyer Intent Modelling in B2B